Compliance Solution

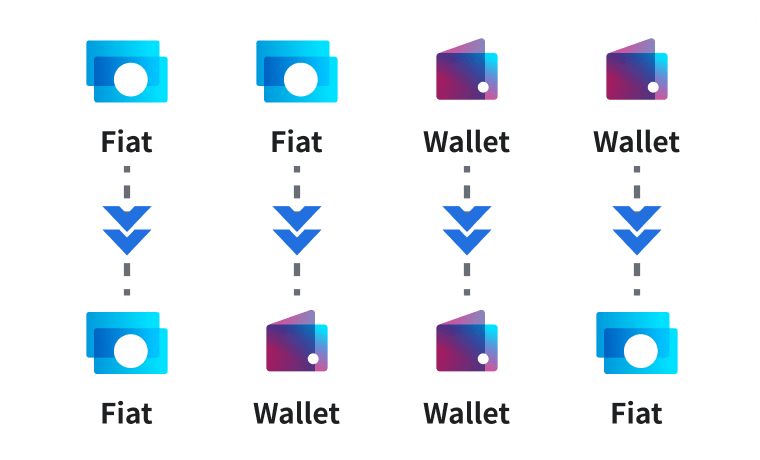

A single solution for BOTH your Fiat and Stablecoin needs

OwlPay's compliance program efficiently conducts KYC, KYB, and AML checks, ensuring regulatory adherence for cross-border payments, including scenarios like fiat, stablecoins, and on-/off-ramp transactions.

Enhancing the existing KYC/ AML compliance process

Pioneering AML Monitoring for Fiat-Stablecoin Conversions in the Industry

Customizable Form Builder

Effortlessly create online forms with drag-and-drop data fields and field validation, enhancing your business's efficiency and cost savings.

Usage Features and Advantages

Automated Data Collection and Validation

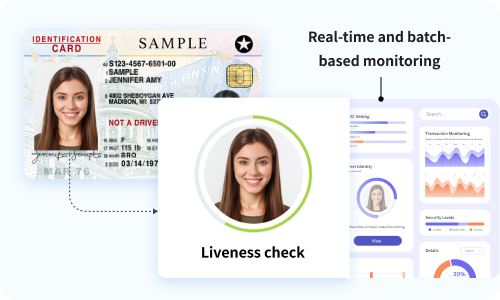

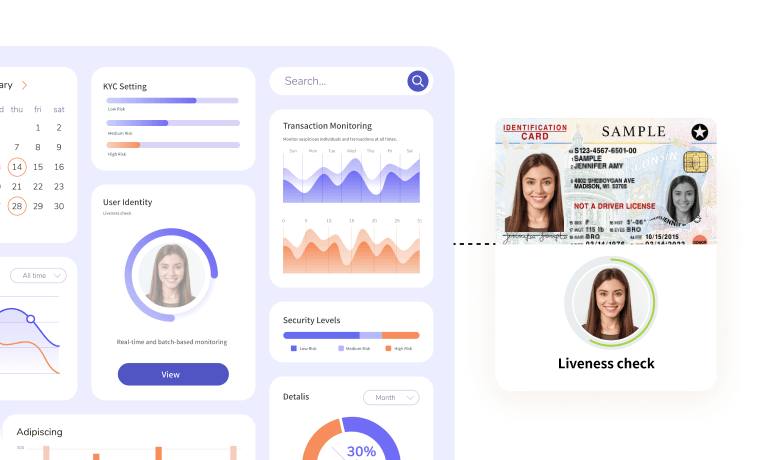

Verify various types of IDs from 200+ countries and territories, with AI-driven name checks achieving up to a 95% accuracy rate.

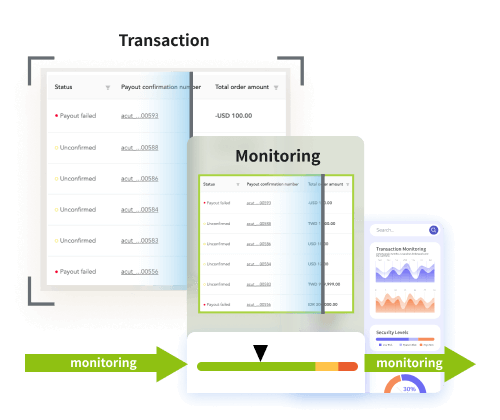

Continuous Monitoring

Advanced transaction monitoring systems provide tiered alert detection for 24/7 real-time risk assessment. You'll receive instant notifications if your customers' status changes.

Global Compliance Standards

OwlPay uses global Anti-Money Laundering (AML) lists for a comprehensive one-stop search to identify and flag potential blacklisted entities.

Premium User Experience

Switching to an intelligent continuous monitoring engine from manual batch processing ensures full compliance and lets you focus on business growth.

ONBOARD

Global Coverage document and liveness KYC user verification

Support types

5000+

Support country / region

200+

END-TO-END KYC AND KYB CHECKS

Frictionless onboarding experience on individual and business checks

Watch list

20,000+

Media resources

36,000+

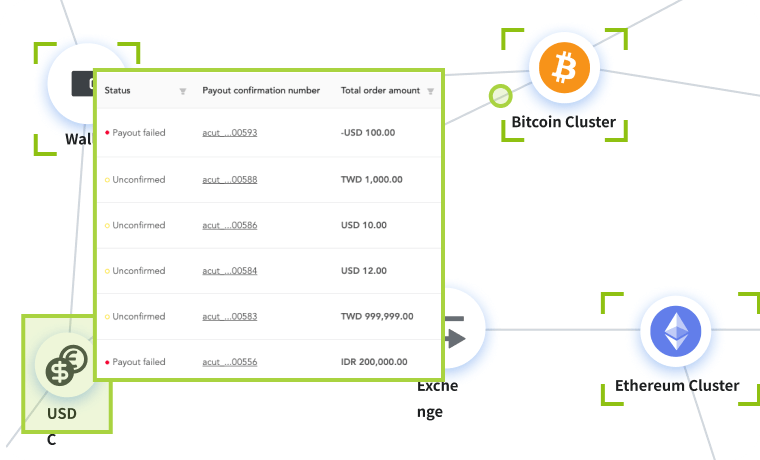

MONITOR

Detecting geographical risk, and transaction alerts for Fiat and Stablecoins

Fiat

Stablecoins

The Imperative of Strengthened Risk Management and Compliance

With diversified payment methods, you must enhance risk management and compliance for international payments.

AML SCREENING

Prevent and manage fraud with a unified approach to identity trust

Our Features

OwlPay incorporates advanced automation to streamline KYC processes for diverse payout scenarios, such as fiat and stablecoin conversions, as well as on-/off-ramp transactions.

Every wallet address will be traced both backward and forward at least hundreds of transactions.

Businesses must adopt digital platforms for automated compliance, as regulators demand. OwlPay offers one stop platform for KYC, AML, and continuous monitoring.

Works where you work

Revolutionize traditional remittance with a digital experience and establish clear acceptance criteria for stablecoin-linked customers to set due diligence levels.

Streamlined integration with single integration via a variety of methods including API and web link, with automated sanctions screening, and OFAC compliance for every transaction.

Businesses can meet local KYC compliance with cross-platform integration, adhering to government mandates, and providing tax evidence for fiat transactions.

One-stop AML service we provide can put you at ease

Businesses can comprehensively guide customers online by optimizing the user digitalization experience while ensuring full compliance with regulations.

BENEFITS

Fast-track client onboarding by speeding up KYC checks and focusing on growing your business, safely.

Help abandonment rates by providing a smooth, frictionless onboarding experience to your KYC checks.

We make it easy for you to comply with the latest AML and KYC regulations when onboarding new clients.

Ready to get started?

Book your free demo of our comprehensive Anti Money Laundering solution to solve your remediation pain today.

Contact Us